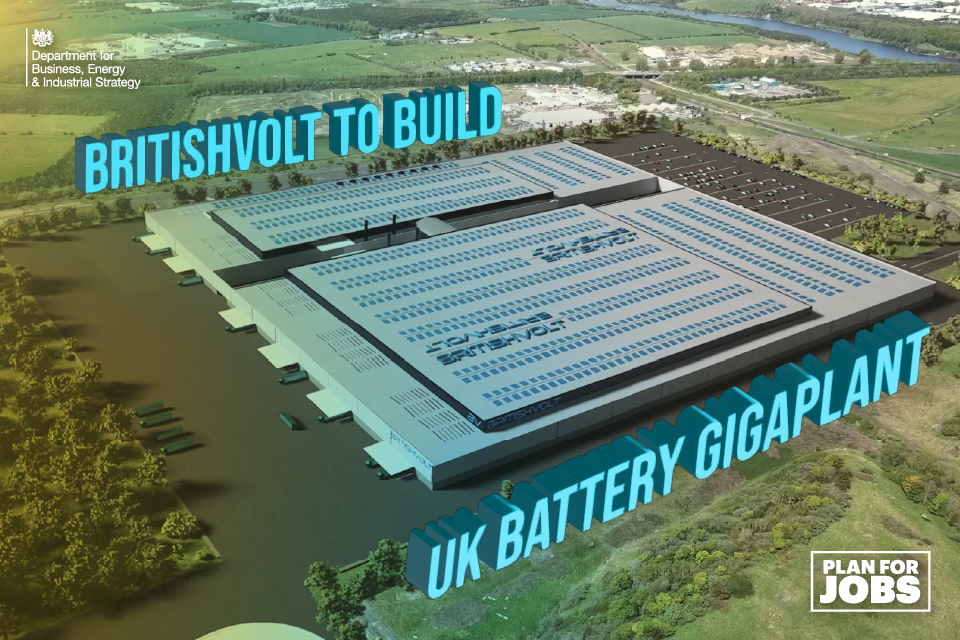

Britishvolt, a venture which aims to build the country’s first large-scale battery plant for electric cars, has secured a £200m funding boost from backers including Glencore.

The FTSE 100 commodity trader has contributed £40m to a funding round which values Britishvolt at almost £800m, despite its planned gigafactory site in Northumberland having not yet made a single battery.

The deal comes after the Government contributed £100m to underpin a £1.7bn sale and leaseback of the property near Blyth last month. Britishvolt has said it aims to be up and running by the end of next year.

Glencore’s involvement in Britishvolt’s third equity funding round reflects the opportunity opened up for the commodities industry by the need for copper, cobalt and other metals and minerals in batteries.

The company was already a shareholder and is targeting rapid growth in the sale of electric cars as it comes under shareholder pressure to exit traditional markets such as coal.

News of the investment came as Glencore posted earnings for 2021, in which it revealed it had set aside $1.5bn (£1.1bn) to resolve corruption investigations in the US, UK and Brazil.

Glencore said it was expecting these investigations to be resolved this year, four years after it first emerged that it was under investigation by the US Department of Justice over allegations of money laundering and bribery. Chief executive Gary Nagle said: “We recognise that there has been misconduct in this company historically and there were flaws in our culture and we’ve worked very hard to correct that.“We want to complete these investigations, put a line under that and move forward.”

It came as Glencore posted its highest ever profit for 2021, with adjusted earnings having almost doubled during the year to hit $21.3bn. Revenue was up 43pc year-on-year at $203.8bn, as Glencore said there had been rising demand for its metals and energy products.

The company said it had seen “multi-year or record high prices for many of our commodities” during the year.

Glencore is one of the world’s largest producers and exporters of thermal coal, which is used to generate electricity. It has recently faced pressure from activist Bluebell to spin off its coal business due to both “financial and environmental considerations”.

However, unlike other miners who have already sold their coal mines or laid out plans to withdraw from the sector, Glencore has maintained that its plan is to run down the mines over the next 30 years.

Glencore said it would be returning $4bn to shareholders as part of a buyback programme, thanks to the “significant improvement” in its financial results.